Hydrogen cars are not the future. If you’ve invested in hydrogen outside of last mile civic transportation in a pro-nuclear energy government (i.e. China mass transit), you’ve made a mistake.

Energy is the biggest challenge of our generation. Literally.

Energy is the driver of economies. It is connected to every aspect of our society. High energy prices lead to economic distress. Low energy prices lead to economic growth. This is physics manifesting in economics. It is the largest economic driver and recent events in Germany amplify this signal. For more on this topic, please read these verbose but excellent blog posts by an amazing physicist.

Why hydrogen?

Sadly, the U.S. and EU have no viable energy policy. Most political extremes are driving us toward climate destruction. Belief in the reliance on fossil fuels or belief in non-nuclear renewable energy will lead to failure. Germany-Russia-Ukraine was the proverbial “final nail in the coffin.” It showed that renewables do not satisfy the need for reliable, low-cost energy when we need it most. We are stuck in a religious political belief system destined for catastrophe. We feel helpless.

Enter hydrogen.

Hydrogen has many advertised advantages. It boasts 100 times the energy density of batteries, two to three times the energy density of gasoline, and it is the most abundant element in the universe. Most importantly, when hydrogen burns, the clean byproduct is water.

If a founder makes the claim that hydrogen is the most abundant element in the universe, this is rhetorical deception at its greatest. As an investor you should discount and leave.

Hydrogen IS the most abundant element in the universe, comprising greater than 75% of normal matter. However, on Earth, hydrogen is energetically frozen and unavailable energy for work.

The problem: hydrogen is not fuel.

Fuels are energy stored by the environment. A fuel’s energy is piled up by the environment, and is there for our utilization after extraction, refinement, delivery, and storage.

What qualifies as a fuel? Fuels gain energy from the environment over millions of years or from astronomical events. Fossil fuels are millions of years of solar and potential energy stored in solid and liquid by the environment. Nuclear fission is stored energy from supernovae in heavy elements. Solar is actually nuclear (solar nuclear fusion), and wind and hydroelectric are actually solar.

Molecular hydrogen IS a fuel. Unfortunately, molecular hydrogen is rare on Earth. Hydrogen is already burned by the environment to form water and other compounds. It is difficult and energetically expensive (also economically) to separate hydrogen for its use in fuel cells or combustion.

What is a viable fuel (energy)?

There are many things that make energy or fuels appealing. These include environmental impact, cost, ease of transportation, storage and safety, as well as reliability and energy/power density. The energy ecosystem is replete with complexity, both economically and politically. We will only lightly touch on these issues. Regardless of these complexities, there is one uncompromising requirement that a fuel is viable: The energy extracted at utilization must be more (preferably much more) than the energy lost in the process from the source to utilization.

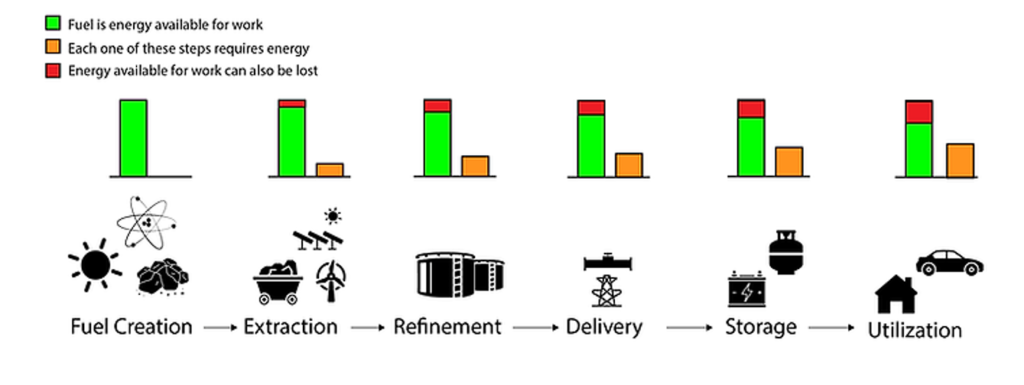

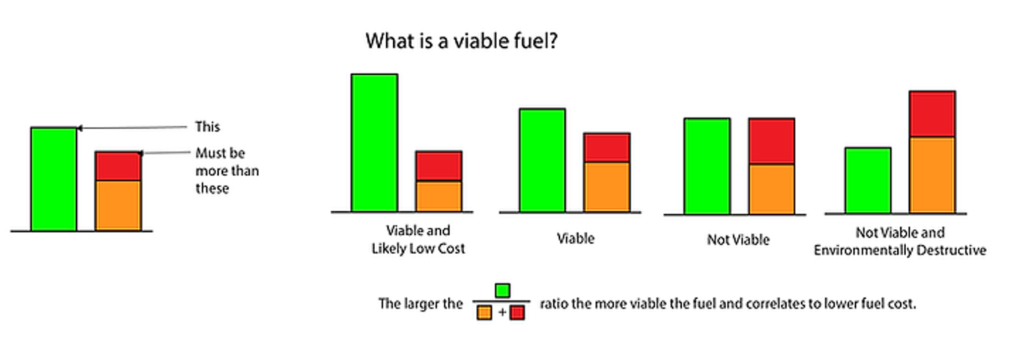

The figure below is a generalized process chain that all fuels undergo. There are nuances to this process, and this representation isn’t exact, but the point is fundamental and valid. The bar graphs represent the total energy available in a fuel (green), the energy added from another fuel in the process (orange) and inefficiencies in the process which will never be non-zero (red). Different fuels will have different green/orange/red levels at different points in the process. For viable fuels, the amount of green must be more than the combined amount of orange and red in this figure. We introduce a ratio (green divided by red + orange) as the Energy Viability Ratio (EVR). This ratio closely relates but is a more empirical value than Energy Return on Investment (EROI).

This is the key difference between gasoline and hydrogen. Millions of years of solar (biological life) and gravitational potential energy went into the creation of crude oil. Once refined/distilled into gasoline, that energy is readily available for combustion. Hydrogen is frozen into water and other chemicals. We must supply that energy (that the Sun and Earth provided to oil ) to hydrogen. Only then is it available for fuel cells or combustion.

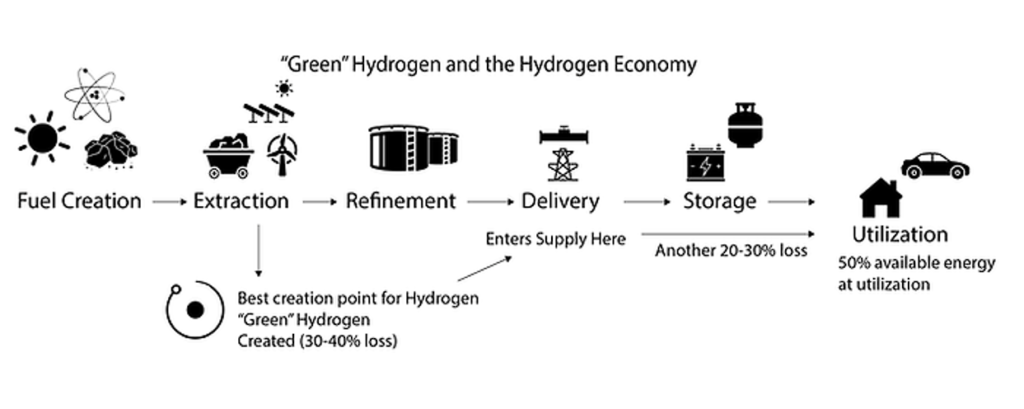

So called “green” hydrogen is produced at solar plants, hydroelectric plants and wind farms. 30-40% is lost in just the creation of hydrogen gas, and another 20-30% is lost in compression and delivery. Only 50%, at best, is available at utilization. Only in niche applications would we choose this channel over a conventional channel that only realizes a 10-15% reduction in transmission and battery storage.

Creating hydrogen is energetically wasteful compared to other energy storage. Storing and delivering hydrogen is even more energetically wasteful. This energy (since energy cannot be created or destroyed) is provided by a fuel and is likely delivered from fossil fuels, at an efficiency of half that in electric vehicles. The weight differential advantage between hydrogen and lithium batteries in cars does not come close to making up the difference.

Many pro-hydrogen ideologues argue that the lack of hydrogen infrastructure is to blame for mass adoption in transportation. Some have suggested installing engines that can create, compress and store hydrogen at home. Creating and compressing hydrogen at home or some significant distance from an energy source would mean nearly 80% of that energy source would be lost.

Examples – The Effect of Hydrogen on the Energy Infrastructure

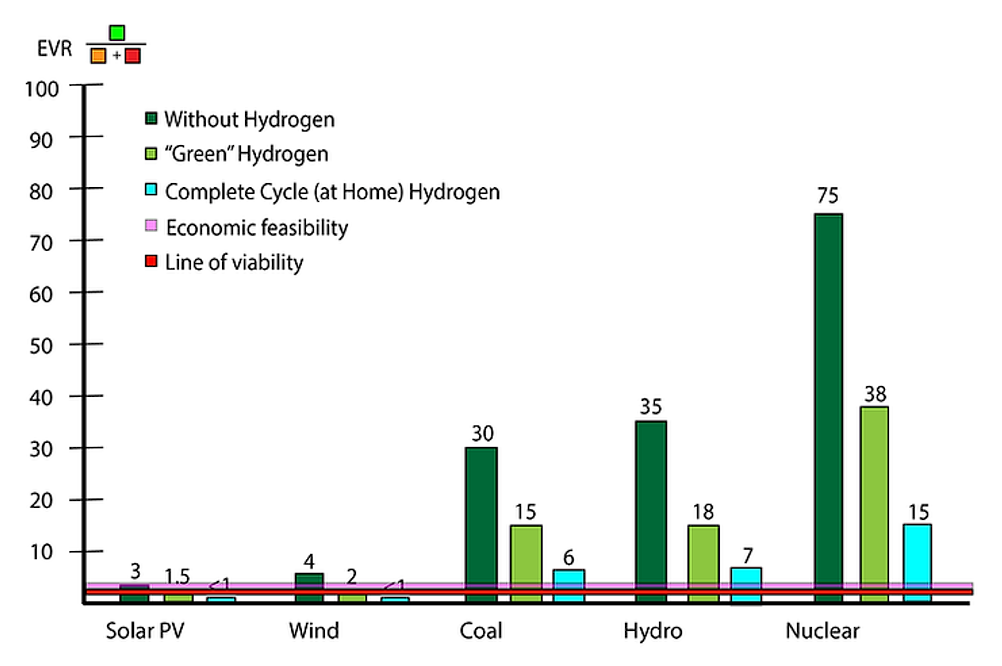

The myth of a hydrogen future and that of a hydrogen economy can be debunked by the above figure. The bar graphs represent the EVR for a hydrogen-less economy, a “green” hydrogen economy, and one envisioned by proponents of complete cycle (at home utilization of hydrogen generation and storage). There are many debates in the energy industry about the values of these numbers for different fuels, but these are the most basic, and our choices the most forgiving. Their values include delivery, intermittency, storage and maintenance. They do not include the environmental impact, which is highest for coal, but also significant for solar and wind. The pink line represents an optimistic value for economic feasibility at 2.5, while other sources have it as high as 7. The red line is the break-even point for the energy viability ratio of 1.

Consequently, hydrogen would have a devastating impact on our energy industry. No amount of economy of scale, infrastructure or technological breakthrough can impact this fact. Hydrogen will never be a future for cars or mass adoption for energy storage. This analysis also debunks any claim of “green” hydrogen. We are currently pushing renewables to their limit and they are just becoming economically and energetically viable. Removing 50-80% of their energy output for hydrogen would make them energy “sinks.” This would unravel any renewable progress we have made toward limiting carbon, effectively setting us back decades.

Founders are often true believers when they should be scouts. Founders will use other more rhetorical numbers when discussing energy, they will speak to advances in hydrogen production efficiency or advances in storage technology. These advances will come at some other economic cost and should be viewed with skepticism if not disdain.

This figure also explains the relatively aggressive investments by China in last-mile civic transport. China is achieving an abundance of nuclear and hydroelectric energy close to population centers. This investment in viable energy is allowing for Hydrogen in cleaner transportation, and thus cleaner skies. This will not be the case for the EU and the USA.

What’s next for hydrogen?

Hydrogen technologies will find niche applications where weight, power and energy density matter the most. This may be in producing environmentally-damaging sports cars. It could also find use in aviation or military applications. The question venture capitalists must ask is do these markets justify those investments?

What is the Cyrannus bet on your hydrogen investment? You will lose LP money.

Disclosure: I was part of the Nikola Truck short a few years ago. I made significant capital off the belief that hydrogen energy is nonsense, and the idea that founders in the industry knew it, and any “milestones” or product demos were orchestrated.

Learn about that fallout here.