If you’ve been hiding under a rock, you’re missing the Quantum Computing Hype Machine. This is not to be confused with an actual quantum computing machine. Those may not exist, and they are HIGHLY UNLIKELY to exist in the next 20 years in any mainstream way.

I’m not going to go into a detailed explanation of quantum computing. There are plenty of amazing primers. Here are a few:

- https://www.linkedin.com/pulse/quantum-computing-primer-sagar-madgi/?trk=pulse-article

- https://arthurpesah.me/assets/pdf/qml-talk-vannes-2020.pdf

The advantage of a quantum computer is that it exploits the quantum property of superposition. Classical computers operate on classical bits that can be in a state of 0 or 1. Quantum bits (qbits) can be in any combination state, a superposition between 0 and 1. This gives a quantum computer the ability to solve specific classes of problems exponentially faster than classical computers. Many of these classes of problems are at the heart of modern opportunities and technologies.

Enter the Hype.

Quantum computers promise to revolutionize every aspect of our modern life. They will instantly discover new drugs, defeat all electronic and internet security measures, create superior artificial intelligences, accurately predict markets, and destroy crypto quicker than SBF.

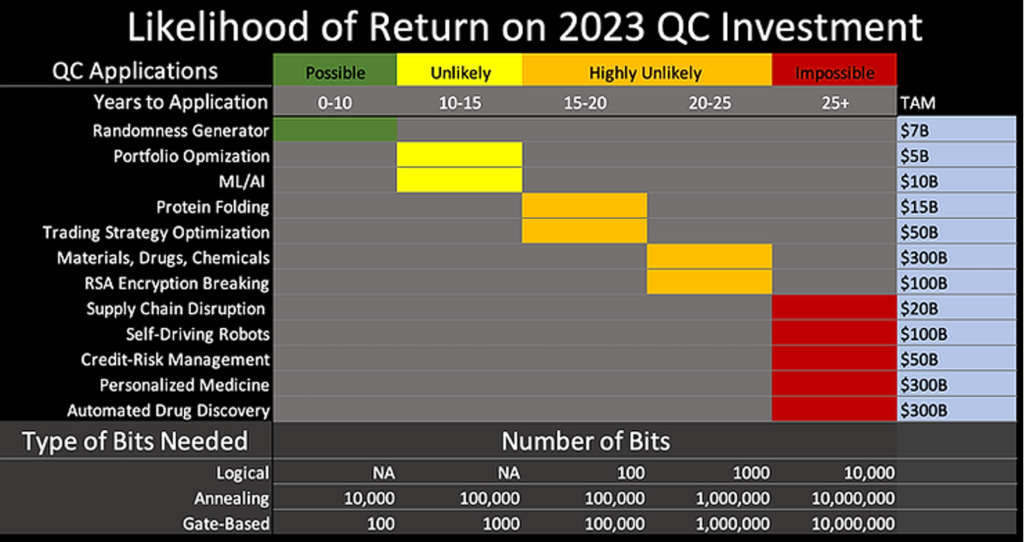

The problem is they likely will never exist at a capacity to solve these problems, and they are extremely unlikely to do so in the next 15-20 years. At that time, applications will likely follow with risk factors equivalent to those of other deep-tech ventures. VCs should expect application investment horizons of 25-30 years. Cyrannus estimates the total investment in the industry to top an additional $100B before application development.

What is the issue? Simply, it is the number of bits required to solve any meaningful problem. Not physical quantum bits, the ones charlatans will cite, but logical quantum bits, the ones that do the work. Logical qbits are collections of physical qbits performing a logical task. It takes many physical qbits to make a logical qbit. At the time of this writing, there are quantum computers that exist up to around 100 physical qbits. For any meaningful application, optimists think the number of logical qbits needs to be at least 10,000, but the scientific consensus places that number in the millions of logical qbits.

Ok, so we just wait? Eventually quantum computers will scale like traditional computers did? There were tons of hurdles for Moore’s Law and classical computer innovators solved those problems and we kept doubling their capacity every one to two years. Why are you so certain this will not be the case for quantum computers?

This is the ultimate reasoning failure with deep-tech investors with no domain expertise in the fields they fund. Hydrogen, indoor farming, clean tech, etc.

Investors cannot differentiate between the likely, the unlikely, the highly unlikely, and the impossible. For hydrogen – there is no way to innovate around the First and Second Laws of Thermodynamics. Unless we find large stores of molecular hydrogen, the hydrogen economy is impossible.

For quantum computer applications it varies from the unlikely to the impossible. The challenge is that nature makes building large-scale quantum computers extremely difficult. As quantum computing systems become large, they become exponentially more powerful, but they also become exponentially noisy, and more susceptible to errors.

So why the interest in quantum computing? Why are the government, companies, and universities spending billions on QC research? Why are there commercialization plans being funded by the government if these systems are not feasible? The answer is the 3 Ms of bad investing attribution: Mandate, Marketing and Misunderstanding.

Mandate is driven by non-experts. Here I refer to commercialization efforts of quantum computers, not research efforts. Research is important, however the valley of death is wide and deep for quantum computing applications. Beyond research, most of the commercialization efforts are in the military industry.

Most decision makers in the military industry have a huge gap in understanding of tech and the projects they fund. The military industry is predominantly a research industry. Much of the funding awarded to companies (through military pending) is designed to create a pool of talent and facilities to stay state-of-the-art. Quantum computing funding allows a frictionless funding avenue to these companies in the DoD budget.

Mandate drives 2% of military commercialization efforts. The world is a political one, and funding is the gears of the political machine. The market and expert consensus should be your validation, not funding sources. The gap between research and application in military and university is often a few decades.

Marketing drives quantum computing commercialization efforts in large corporations like Google and IBM. These companies must communicate to shareholders they are leading-edge technology companies. Marketing also drives VC investment as VCs will use deep-tech to pump deals in private markets so they can attract capital for their next fund.

VCs make money on the size of their fund, not necessarily on the quality of their investments. Most VCs will raise additional funds well before any liquidation horizon on previous investments. Therefore their valuations are used to illustrate past performance. This is an extreme misalignment of incentive.

Misunderstanding drives FOMO, creating and adding to the hype machine. Do not invest in anything you do not have deep domain expertise in.

If you choose to invest in a quantum computing startup, here are a number of ways that charlatans in the market deceive.

Ways that companies deceive:

Declaring quantum computers are going to exist. This is a lie. We do not know. The consensus is they are unlikely to exist on an investment time horizon.

Padding teams with advisors like military leaders with tons of acronyms after their name and 30 plus years of experience. Most directors or senior-level individuals in DARPA, AFRL, the Northrup’s, etc. have not been actively involved in technology for decades. They are managers. Especially in regards to quantum computers, they do not have the ability to qualify most of the information they are given. This is an argument from authority. You should always seek the consensus of experts. You can uncover this by asking them to do detailed work. If they then backtrack and deflect to a more technically dedicated individual they have been exposed.

Lack of familiarity with the science. Did they graduate from a credible PhD program? Are they published and cited in reputable journals? Do they have years of experience building and operating these systems? If the answer is no, then they are unqualified with leading or executing a viable plan. This translates to all deep-tech investments. Be wary of any deep-tech company without a CEO in the industry or a CTO founder with the same experience. Regardless, your due diligence should not rely on one person, or a group of people. Always seek the consensus! (This is a primary reason for Cyrannus!)

Exaggerating about known quantum use cases. Known quantum use cases are not viable for applications. Google’s quantum supremacy marketing is just that, marketing. It is a made up metric that is irrelevant. Any reference to quantum computers performing some amazing task at the time of this writing is nonsense.

Claiming you can break up problems into classical and quantum parts to be able to use smaller quantum computers for advanced tasks. I heard this on a call with a quantum computer company. The tech advisor suggests that while a fully functional quantum computer would be like eating a whole apple, smaller quantum computers with classical computers can “solve the problem one bite at a time.” This is incorrect and deceptive. Analogy is always the harbinger of deception.

Not wanting to disclose IP or have it evaluated. This is a huge red flag. I worked for an AI company for a year evaluating a technology. They would never let me see “The Algorithm.” After a year they finally released it to my team, and it was total nonsense. It was fabricated nonsense. If you invest, have someone look at the IP.

Snowing in or the Gish Gallop. This is a technique used to confuse investors. Facts alone do not yield viability. Analysis of those facts is where most investors fail. Snowing in is the rapid succession of facts and jargon that deceptively lead an investor toward a conclusion that is incorrect. Pepper those conversations with incorrect statements and due diligence practitioners are unable to refute them all, leaving a sentiment of resolution where there is none.

Where should we invest in the quantum computer market?

You might still choose to invest in quantum computers. Perhaps you are investing in novel architectures that will sell into the research market. This is a viable investment. If you are a VC or LP that cares about building lasting, real businesses, I hope this primer will help guide you.